A long-term investment in commercial real estate may help diversify a portfolio, reduce volatility and hedge against inflation. In addition, leases on commercial properties offer the opportunity for rental income and capital appreciation.

Commercial Properties Offer Many Potential Advantages

| Inflation Hedge The law of supply and demand states that with high demand, prices rise. As the demand for real estate rises, owners may benefit from rising rents and property values. The converse can also be true. In an attempt to keep pace with inflation, the Consumer Price Index (CPI), an index that measures the prices paid for goods and services, is commonly used to adjust rents.1 |

|

|

Diversification for Portfolio Efficiency Diversification is a risk management strategy that allocates capital among various investment types within a portfolio to help limit the exposure to any single asset. It aims to balance positive and negative asset performance within a portfolio – thus, reducing overall volatility. Leveraging diversification is an important aspect of portfolio construction. |

| Lower Correlation Correlation is the degree to which one asset moves in relation with another asset. Highly correlated assets move in the same direction at the same time and to the same degree. Low or negatively correlated assets respond differently, sometimes in opposing ways. Combining a variety of assets (diversification) with low or negative correlation in a portfolio may lead to higher long-term returns and reduce overall volatility. Correlation and diversification go hand-in-hand. |

|

| Long-Term Return Potential Investors tend to be drawn to real estate because it offers the opportunity for regular rental income and capital appreciation over the long-term. Generally, investors are willing to forgo some liquidity for the prospect of higher return potential over the long-term. |

Real Estate May Generate Greater Returns with Lower Volatility

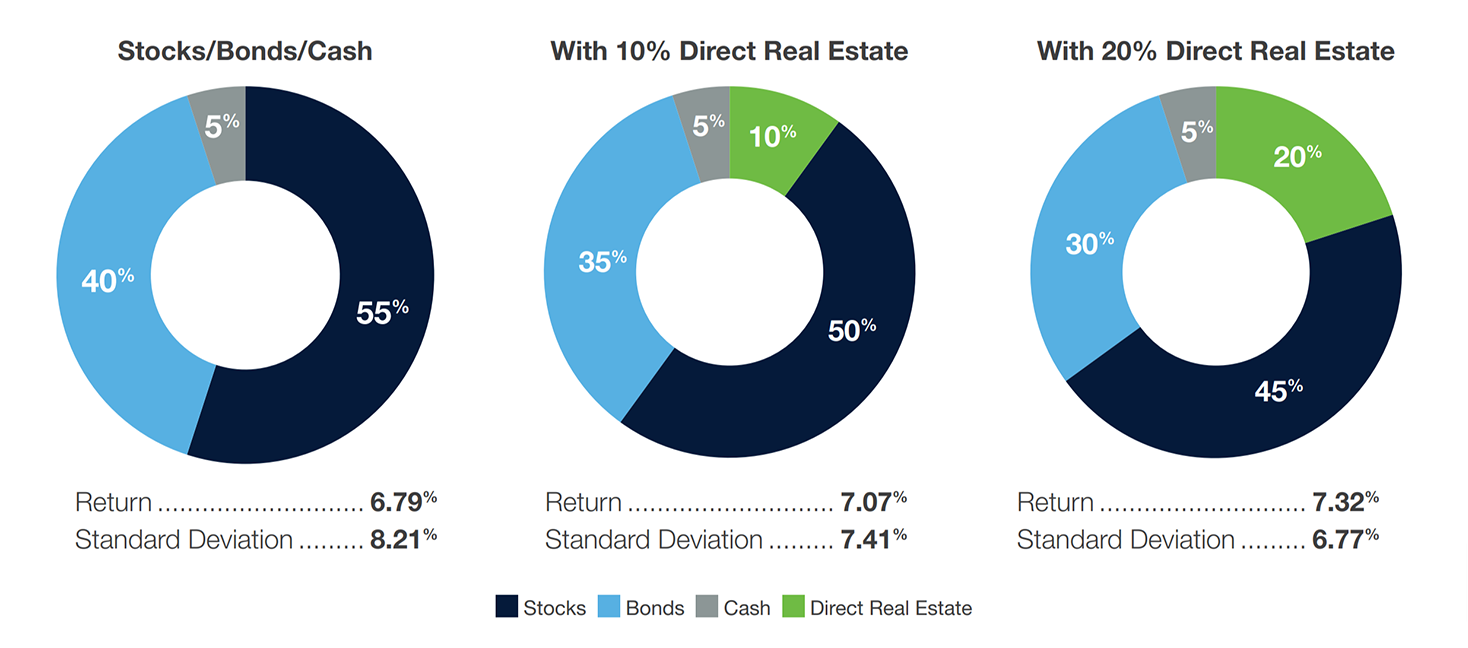

Modern portfolio theory suggests investors construct a portfolio that combines a variety of investments in such a way to reduce risk while achieving optimal long-term returns – real estate being one asset type that has drawn investors’ attention in recent years. Research and historical performance suggest that diversifying an investment portfolio with real estate may provide higher returns.

The chart below illustrates how including real estate into a traditional stock, bond and cash portfolio can boost returns and reduce overall risk, as measured by the standard deviation, over a 20-year period.

20-Year Return and Standard Deviation Review (2000 to 2021)

An allocation to real estate should be considered a long-term investment. Over time, commercial real estate may generate income and capital appreciation while tempering portfolio volatility. By diversifying across stocks, bonds and commercial real estate, the result may be a more resilient investment portfolio.

Sources

1U.S. Bureau of Labor Statistics. How to Use the Consumer Price Index for Escalation. November 2020.

This is neither an offer to sell nor a solicitation of an offer to buy any security, which can be made only by an offering memorandum or prospectus, which has been filed or registered with appropriate state and federal regulatory agencies and sold only by broker dealers and registered investment advisors authorized to do so. An offering is made only by means of the offering memorandum or prospectus in order to understand fully all of the implications and risks of the offering of securities to which it relates. A copy of the applicable offering memorandum or prospectus must be made available to you in connection with any offering.

Past performance is not a guarantee of future results. Charts for illustrative purposes only. Investing 10 or 20 percent in direct real estate both increased the portfolio’s total return and lowered the portfolio’s overall standard deviation.

The charts above compare the returns of the S&P 500 Index, Barclays U.S. Aggregate Bond Index and the NCREIF (National Council of Real Estate Investment Fiduciaries) Index, with and without an asset allocation to direct real estate, over a 10-year time period. Standard deviation is a measurement of the variability of an investment, derived from its historical returns. A higher standard deviation indicates a greater variability of an investment. The S&P 500 Index is a market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance. The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, mortgage backed securities, adjustable rate mortgage pass-through asset backed securities, and commercial mortgage backed securities. NCREIF Property Index (NPI) is the accepted index created to provide an instrument to gauge the investment performance of the commercial real estate market. NPI is an index that reflects the returns of a large pool of individual commercial real estate properties, is leverage free with no fees and includes a blended pool of institutional quality properties.

Each index provides a broad representation of a particular asset class and is not indicative of any investment. Asset allocation does not ensure a profit or protect against a loss. The rates of returns shown do not reflect the deduction of fees and expenses inherent in investing. An investment cannot be made directly in an index.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forwardlooking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- changes in availability and costs of financing; and

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods.

The Inland name and logo are registered trademarks being used under license. This material has been prepared by Inland Real Estate Investment Corporation (Inland Investments) and distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager and placement agent for programs sponsored by Inland Investments and Inland Private Capital Corporation, respectively.

Publication Date: 12/07/2022