The Federal Reserve has raised its benchmark federal funds rate four times starting in December 2015 and has said that it “continues to expect that the evolution of the economy will warrant gradual increases in the federal funds rate over time.”1 Income-oriented investors trying to solve the low yield, rising interest rate challenge need products that can generate income and preserve capital in a rising-rate environment. Real estate investments may help navigate this headwind.

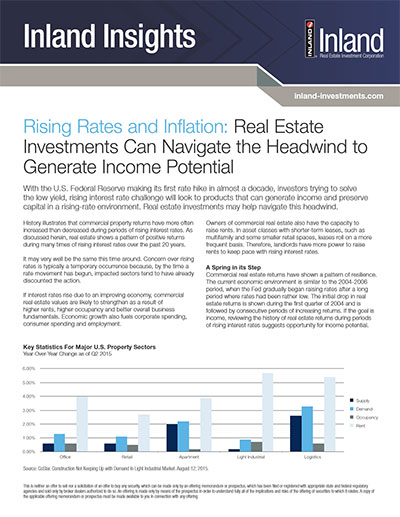

History illustrates that commercial property returns have more often increased than decreased during periods of rising interest rates. In fact, over 20-plus years, real estate shows a pattern of positive returns during many periods of rising interest rates.

Concern over rising rates is typically a temporary occurrence because, by the time a rate movement has been announced, impacted sectors tend to have already discounted the action.

If interest rates rise due to an improving economy, commercial real estate values are likely to strengthen as a result of higher rents, higher occupancy and better overall business fundamentals. Economic growth also fuels corporate spending, consumer spending and employment.

Owners of commercial real estate have the capacity to raise rents. In asset classes with shorter-term leases, such as multifamily and some smaller retail spaces, leases expire on a more frequent basis. Therefore, landlords have more power to raise rents to keep pace with rising interest rates.

A Spring in its Step

Commercial real estate returns have shown a pattern of resilience. The current economic environment is similar to the 2004-2006 period, when the Fed gradually began raising rates after a long period where rates had been rather low. The initial drop in real estate returns during the first quarter of 2004 was followed by consecutive periods of increasing returns. If the goal is income, reviewing the history of real estate returns during periods of rising interest rates suggests opportunity for income potential.

10-Year Historical Treasury Rates

As of October 2017

Source: Federal Reserve. October 2017. The 10-Year Treasury is an important economic indicator and proxy for mortgage rates.

NCREIF Property Index Returns

Highlighted Areas are Times of Rising Interest Rates

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

|---|---|---|---|---|

| 1996 | 2.40% | 2.29% | 2.63% | 2.61% |

| 1997 | 2.34% | 2.82% | 3.38% | 4.71% |

| 1998 | 4.14% | 4.19% | 3.46% | 3.55% |

| 1999 | 2.59% | 2.62% | 2.81% | 2.89% |

| 2000 | 2.40% | 3.05% | 2.94% | 3.33% |

| 2001 | 2.36% | 2.47% | 1.60% | 0.67% |

| 2002 | 1.51% | 1.61% | 1.79% | 1.67% |

| 2003 | 1.88% | 2.09% | 1.97% | 2.76% |

| 2004 | 2.56% | 3.13% | 3.42% | 4.66% |

| 2005 | 3.51% | 5.34% | 4.44% | 5.43% |

| 2006 | 3.62% | 4.01% | 3.51% | 4.51% |

| 2007 | 3.62% | 4.59% | 3.56% | 3.21% |

| 2008 | 1.60% | 0.56% | -0.17% | -8.29% |

| 2009 | -7.33% | -5.20% | -3.32% | -2.11% |

| 2010 | 0.76% | 3.31% | 3.86% | 4.62% |

| 2011 | 3.36% | 3.94% | 3.30% | 2.96% |

| 2012 | 2.59% | 2.68% | 2.59% | 2.53% |

| 2013 | 2.57% | 2.87% | 2.59% | 2.53% |

| 2014 | 2.74% | 2.91% | 2.63% | 3.04% |

| 2015 | 3.57% | 3.14% | 3.09% | 2.91% |

| 2016 | 2.21% | 2.03% | 1.77% | 1.73% |

| 2017 | 1.55% | 1.75% | N/A | N/A |

Source:NCREIF. The National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index (NPI) is an index of quarterly returns reported by institutional investors on investment grade commercial properties owned by those investors. The NPI is used as an industry benchmark to compare an investor’s own returns against the industry average. The NCREIF Property Index is an index of quarterly returns on an unleveraged basis reported by institutional investors on investment grade commercial properties owned by those investors. Inland Real Estate Investment Corporation generally believes that the NCREIF Property Index is an appropriate and accepted index for the purpose of evaluating real estate growth rates. The NCREIF Property Index does not reflect management fees and other investment-entity fees and expenses, which lower returns. Indices are not available for direct investment. Past performance does not guarantee future returns.

Over 20-plus years, 19 quarters have been affected by rising interest rates, which resulted in positive commercial property returns.

As the Fed gradually increases rates over time, real estate investors may experience fluctuating returns in the short-term. That being said, higher rates typically signal a stronger economy, which tends to be associated with a stronger real estate market.1

Hedge Against Inflation

Since most scenarios of rising interest rates triggers conversations of inflation, an added benefit of real estate is its ability to generally provide natural protection against inflation because of higher rents and values.

While rising interest rates should warrant a review of real estate investments, there is an upbeat outlook for commercial property performance. Gradual rate increases and inflation generally are products of a stronger economy. Indeed, Fed Chair Janet Yellen said at a press conference after the June 2017 rate increase that “it reflects the progress the economy has made.”

Sources:

1 Forbes.com. Interest Rates Are Rising Again. Here’s How That Affects Commercial Real Estate. April 5, 2017

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forwardlooking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- changes in availability and costs of financing; and

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods

The Inland name and logo are registered trademarks being used under license. This material has been prepared by Inland Real Estate Investment Corporation (Inland Investments) and distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager and placement agent for programs sponsored by Inland Investments and Inland Private Capital Corporation, respectively.

Publication Date: 11.14.17