Strong Demand for Commercial Real Estate Credit

$5 Trillion U.S. CRE Credit Market Spans Geographies and Property Types

- Incorporating an allocation to CRE credit has historically generated differentiated sources of income and may benefit a multi-asset portfolio outside of the traditional 60/40 model

- Modern portfolio theory advocates diversification to minimize overall volatility or “risk” by investing in a variety of asset classes to weather different market conditions

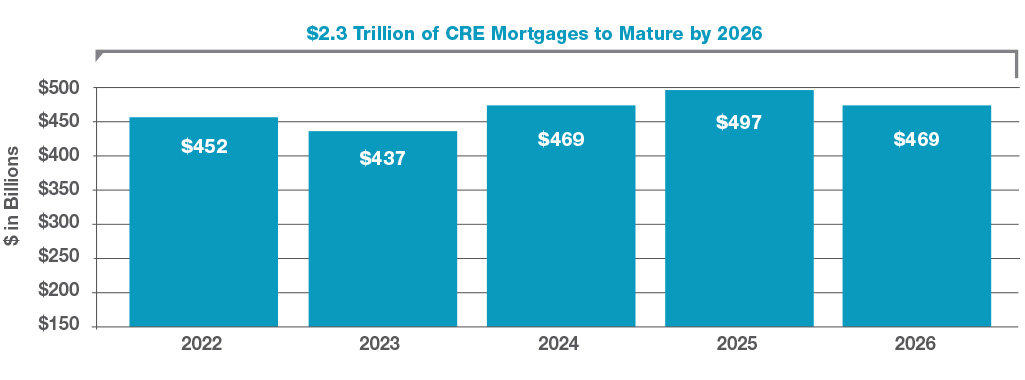

- Large and diverse $5 trillion CRE credit investment opportunity with $2.3 trillion of mortgages set to mature by 20261

- Complements a real estate equity allocation and provides the opportunity to diversify a traditional fixed income portfolio

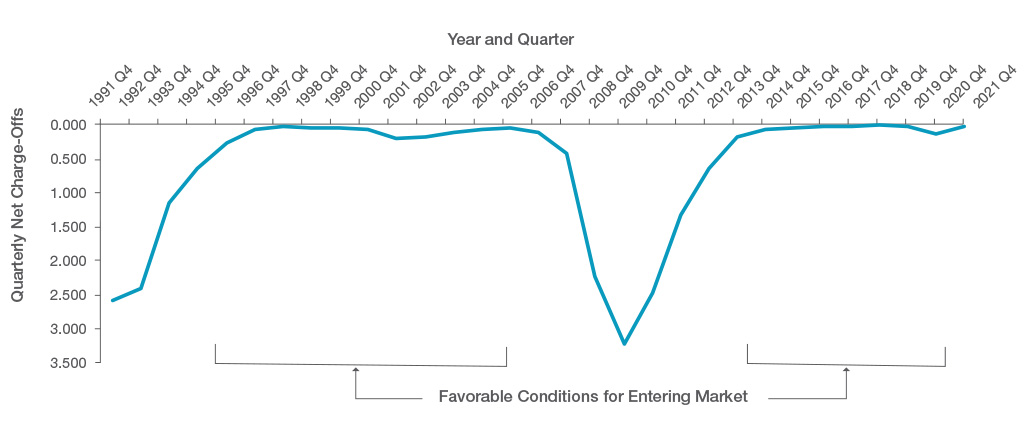

CRE Loans Generally Have Performed Well Across Market Cycles2

- Quarterly CRE loan net charge-offs have averaged 0.48% over the last 25 years

- Historically, CRE loan net charge-offs have only spiked during major financial crises, and loans have performed well overall through up and down economic cycles

- CRE loan net charge-off rates include construction lending, which is not a focus of InPoint’s investment strategy

This website is neither an offer to sell nor a solicitation of an offer to buy any security which can be made only by a prospectus or offering memorandum, which has been filed or registered with appropriate state and federal regulatory agencies, and sold only by broker dealers and registered investment advisors authorized to do so. All of the content on inland-investments.com is subject to terms and conditions available on Important Disclosures.

The Inland name and logo are registered trademarks being used under license. "Inland" refers to The Inland Real Estate Group of Companies, Inc. which is comprised of a group of independent legal entities some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof including the Inland Real Estate Investment Corporation (Inland Investments) and Inland Securities Corporation. Inland Securities Corporation, member FINRA/SIPC, is dealer manager and placement agent for programs sponsored by Inland Investments and its affiliates. For more information on Inland Securities Corporation, visit FINRA BrokerCheck.