Download our Fact Sheet: Building Wealth via the 1031 Exchange

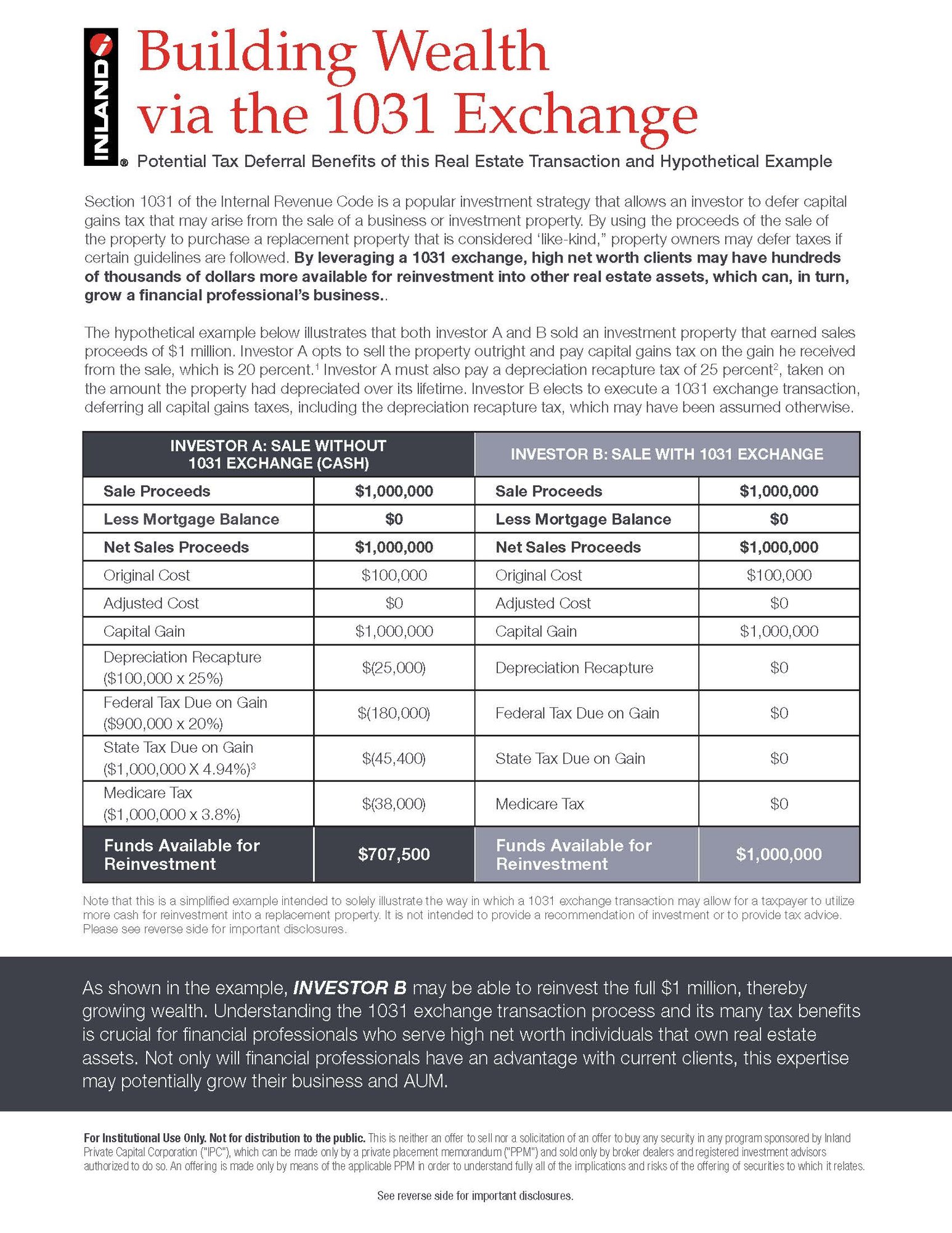

Section 1031 of the Internal Revenue Code is a popular investment strategy that allows an investor to defer capital gains tax that may arise from the sale of a business or investment property. By using the proceeds of the sale of the property to purchase a replacement property that is considered ‘like-kind,” property owners may defer taxes if certain guidelines are followed. By leveraging a 1031 exchange, high net worth clients may have hundreds of thousands of dollars more available for reinvestment into other real estate assets.

Download this informative resource to learn more about the tax advantages of utilizing a 1031 exchange, including a hypothetical example of an investment with and without a 1031 exchange.

Education & Resources

Student Housing

Download to discover why we see student housing remaining a compelling long-term real estate strategy.

Commercial Real Estate

Phil McAlister, Head of Research, shares his perspective on the forces shaping the commercial real estate landscape in 2026 and...

Capital Markets

Download this in-depth report which explores the key factors we see positioning commercial real estate well in 2026 and beyond.